How much do Americans think it takes to be considered wealthy: Charles Schwab Survey 2024

While wealth means different things to different people, Charles Schwab's study reveals that Americans believe it takes an average of $2.5 million to be considered wealthy. An average net worth needed to be financially comfortable is $778,000.

Photo: Pixabay

Net worth is a financial metric that represents the total value of a person’s assets minus their liabilities. It is what you own (assets like home, savings) minus what you owe (liabilities like mortgages, credit card debts). Having a positive net worth, when assets exceed liabilities, serves as an indicator of financial health.

On August 21st, Charles Schwab published results from its Modern Wealth Survey 2024. The online survey was conducted from March 4th to March 18th, 2024 among a national sample of Americans aged 21 to 75, and 1,000 adults participated in the study. Not surprisingly, the numbers went noticeably up this year if compared to the year ago. Results also vary by different ages of respondents and their geographical locations.

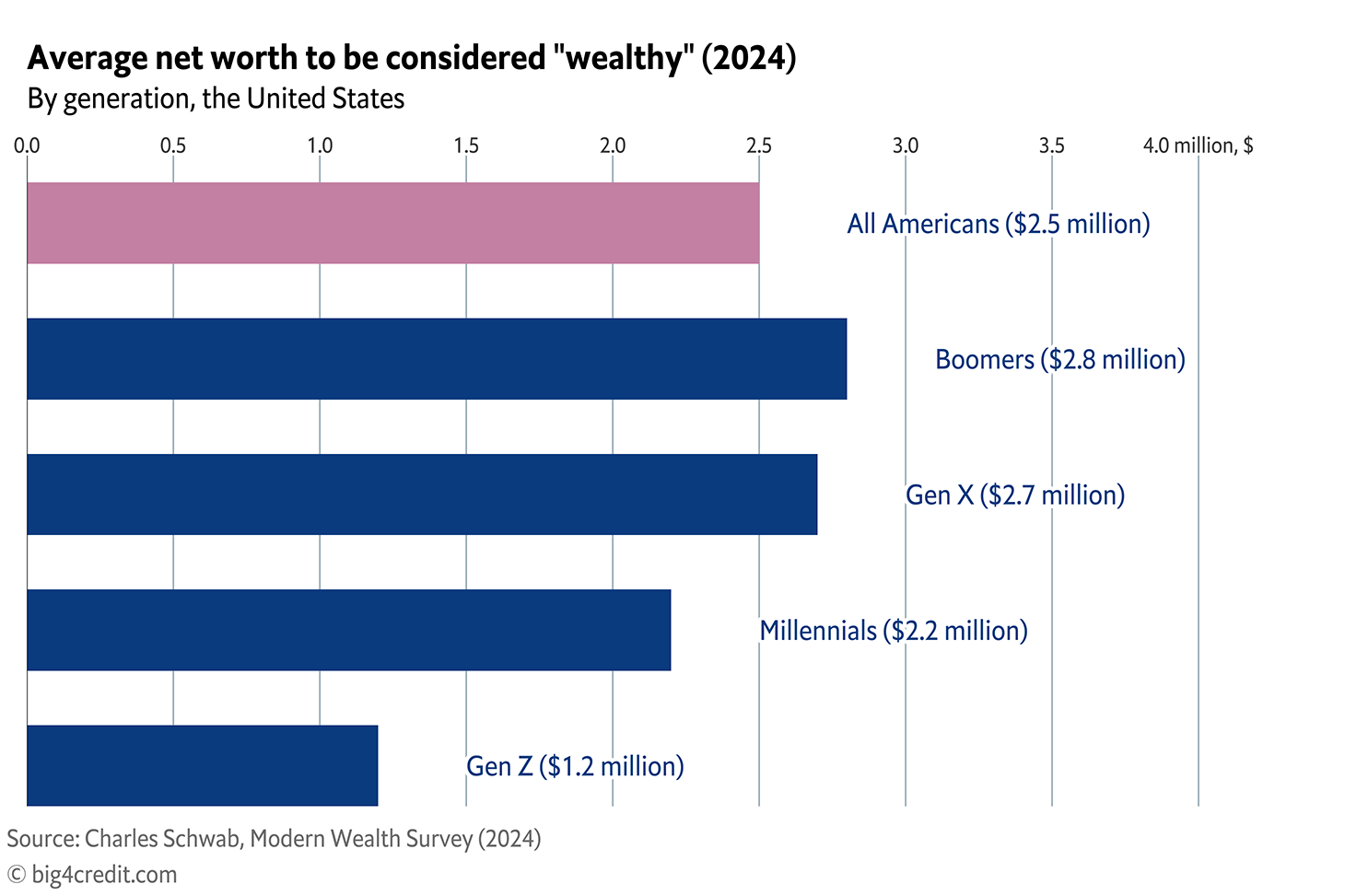

In 2024, on average Americans say you need a net worth of at least $2.5 million to feel wealthy. As opposed to that, to feel wealthy in 2022 and 2023, Americans needed a net worth of $2.2 million on average. This turns out to be more than a 10% increase.

By generation, results are more than 100% apart between Boomers and Gen Z, with Millenials to be in between and Gen X closer to Boomers. The threshold of what it takes to be wealthy for Boomers is $2.8 million, while Gen Z believes that the minimum net worth of $1.2 million would be already enough.

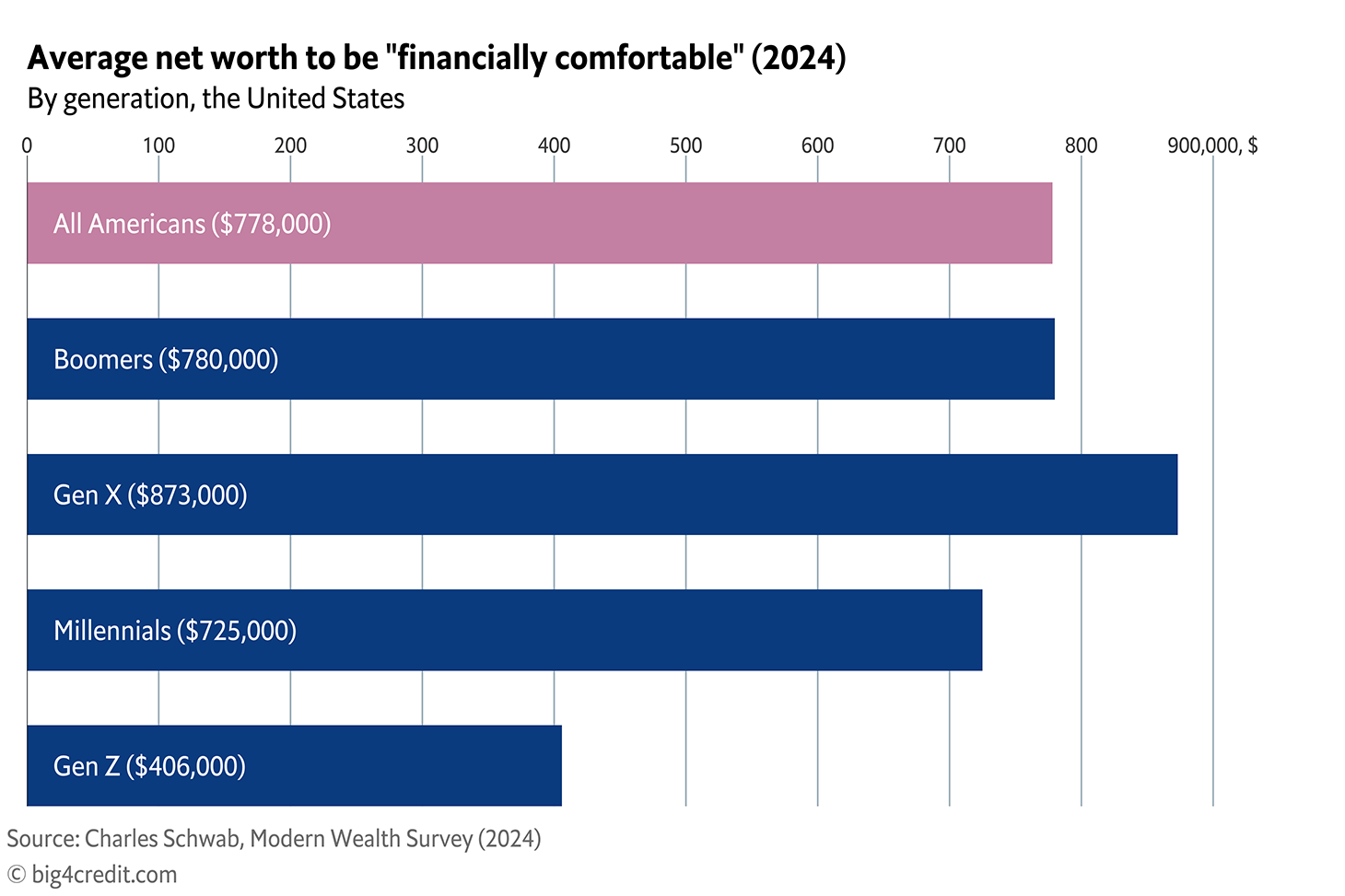

At the same time, to feel financially comfortable Americans say that the average net worth needs to be at least $778,000. Among all generations, Gen X has the highest threshold of $873,000, while the lowest threshold of $406,000 belongs to Gen Z. Boomers are very close to the “average American” expectation with the corresponding threshold of $780,000. Millennials have about 10% lower threshold than Boomers or the “average American”, and it equals $725,000.

By location, San Francisco takes the highest net worth threshold in the nation, $4.4 million; whereas Southern California has an average net worth of $3.4 million. The top 10 U.S. cities reported substantially lower thresholds of net worth to be considered wealthy.

Average net worth it takes to be “wealthy” by geographical location,

- San Francisco - $4.4 million

- Southern California - $3.4 million

- New York - $2.9 million

- Washington, D.C. - $2.8 million

- Denver - $2.8 million

- Seattle - $2.8 million

- Boston - $2.7 million

- Atlanta - $2.4 million

- Chicago - $2.3 million

- Houston - $2.3 million

- Phoenix - $2.3 million

- Dallas - $2.2 million

Average net worth it takes to be “financially comfortable” by geographical location,

- San Francisco - $1.5 million

- Southern California - $1.2 million

- New York - $994,000

- Washington, D.C. - $968,000

- Denver - $876,000

- Seattle - $789,000

- Boston - $903,000

- Atlanta - $781,000

- Chicago - $813,000

- Houston - $662,000

- Phoenix - $650,000

- Dallas - $724,000

Americans generally rate themselves positively when it comes to their personal finances, including their savings, investments, and retirement preparedness. Surprisingly, only a third of Americans have a written financial plan, which gives them greater control over their finances and confidence in reaching their financial goals.

When asked if they think they will reach the minimum net worth threshold within their lifetimes, 21% of Americans say they are on track to be wealthy. Millennials and Gen Z are the most optimistic generation which believe in becoming wealthy during their lifetimes.

Survey Notes

Generational Definitions:

- Gen Z: 1997-2002 (21-26)

- Millennials: 1981-1996 (27-42)

- Gen X: 1965-1980 (43-58)

- Boomers: 1948-1964 (59-75)

Generations:

- Gen Z - 9%

- Millennials - 31%

- Gen X - 33%

- Boomers - 27%

Gender:

- Man - 49%

- Women - 50%

HH Income:

- Mean - $91,000

- Median - $68,000

Investable Assets:

- Mean - $295,000

- Median - $38,000

Employment:

- Full-time - 50%

- Part-time - 11%

- Retired - 22%

- Other - 17%